The black community owned 0.5 percent of America’s wealth at the end of slavery, and today that number has barely increased. A typical white household is 10 times wealthier than a typical black household, and the racial wealth gap is growing.

So what is the solution? Scholars Sandy Darity and Mehrsa Baradaran argue it lies beyond income and education. Policymakers must turn attention to increasing black families’ wealth through reparation programs, eliminating barriers to home ownership and increasing access to capital.

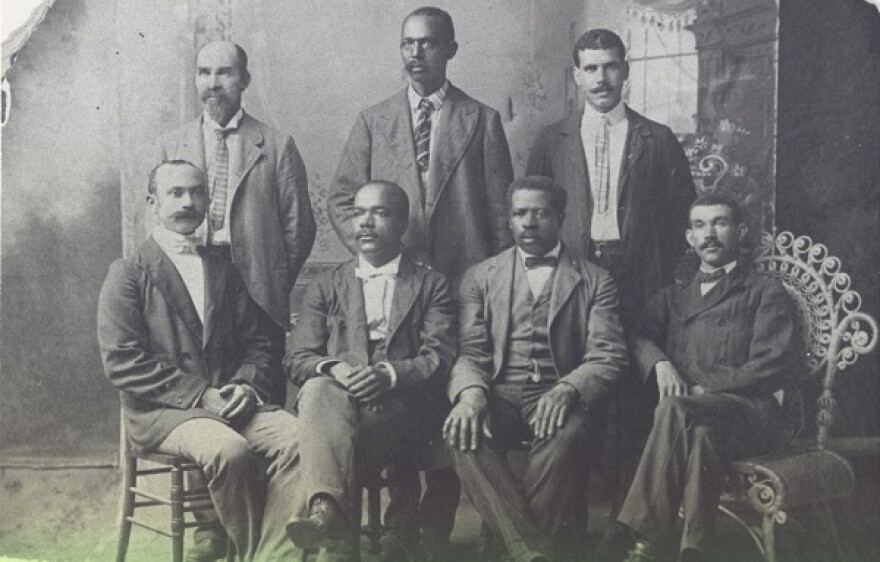

Host Frank Stasio talks with law professor Mehrsa Baradaran about her new book “The Color of Money: Black Banks and the Racial Wealth Gap” (Belknap Press of Harvard University Press/ 2017). In it Baradaran argues the idea that black Americans can fix the wealth gap on their own is not only flawed, but also ignores the history of discriminatory policies that robbed black families of their capacity to build wealth in the first place.

"I'm just trying to educate people [about] what won't work. What won't work is letting capitalism fix the problems that social policy created." Mehrsa Baradaran

Darity, director of the Samuel DuBois Cook Center on Social Equity at Duke University, discusses his work on reparations and policy ideas to close the racial wealth gap. The two speak at an event at the University of North Carolina School of Law on Tuesday, Feb. 27 from 4:15 p.m. to 7 p.m.

Interview Highlights:

Baradaran on why the racial wealth gap has barely budged in 150 years:

In 1865 when slaves are emancipated ... Freedmen and freed blacks have about 0.5 percent of the nation's wealth at the time ... Today that number has barely budged. It is about 1-2 percent. So, any efforts at wealth accumulation for the black community have been an utter failure ... There's another economic story that once you have a racial wealth gap that is that wide, it continues to self-perpetuate without actually continuing input ... Wealth creates more wealth unto itself. And the lack of wealth, also, has this vicious cycle downwards. You don't actually need banks to be racist ... Even a race-neutral credit score or race-neutral applications will continue to self-perpetuate that racial wealth gap, because without wealth you have poor credit. You have more debt. You have lower ladders out of poverty.

Baradaran on why pointing to black banks to fix the racial wealth gap is a problem:

You can't segregate money. Money is going to flow into the network of money. You can have a black bank that has black depositors and loans into black neighborhoods, but that money is going to eventually end up in the holders of property. Those are the people who hold the assets, and that's how banks work. They're able to multiply money only so far as they're part of an integrated network of other banks that are lending and borrowing from each other.

"Blacks who have a college degree have two-thirds of the net worth of whites who never finished high school ... And blacks working full time have less wealth than whites who are unemployed."- Sandy Darity

Darity on why it's a myth that education is responsible for the racial wealth gap:

The conventional things that people think will cure the problem don't seem to do so, particularly when we're looking at wealth or net worth, which is the difference between what you own and what you owe ... Blacks who have a college degree have two-thirds of the net worth of whites who never finished high school ... And blacks working full time have less wealth than whites who are unemployed. So, working hard, gaining additional education and the like doesn't seem to have much of an effect in closing the gap in wealth between blacks and whites ... The wealth gap is due to the intergenerational transfers of resources.

Darity on what can be done to fix the racial wealth gap:

One of the significant ways in which you could move to close the racial wealth gap is to have a substantial program of reparations for African-Americans. You could directly tackle those disparities. There is also another option … Which is to have a program that could be put in place which is not specific to blacks. It's a universal program, but it could be designed in such a way that it would work to the relative advantage of those folks that have the least wealth ... It’s a wealth-based program. We call it the “Baby Bonds Proposal” … It’s a trust fund for each newborn infant … This trust fund would be publicly funded and publicly provided ... We would vary the amount of the trust based upon the child's family's wealth position.