While General Assembly leaders are in the final stages of sending Gov. Pat McCrory a state budget, they're rushing to wrap up bills on taxes and economic development.

Republican and Democratic representatives grilled Commerce Secretary Sharon Decker on Wednesday, asking why the governor wants to create a $20 million "closing fund" to bring business to North Carolina.

"We know factually that a number of large international automotive companies are going to build North American plants in the next five to ten years," Decker said. "We want North Carolina to be in a position to go after some of those large manufacturing opportunities."

Members of the House finance committee recommended against that fund - and against a plan to cap sales taxes statewide at 7.25 percent. Some say they would like to allow urban counties like Mecklenburg and Wake to raise sales taxes to 7.5 percent. Wake County commissioners have said they'd like to use revenue from sales taxes to pay for transportation projects.

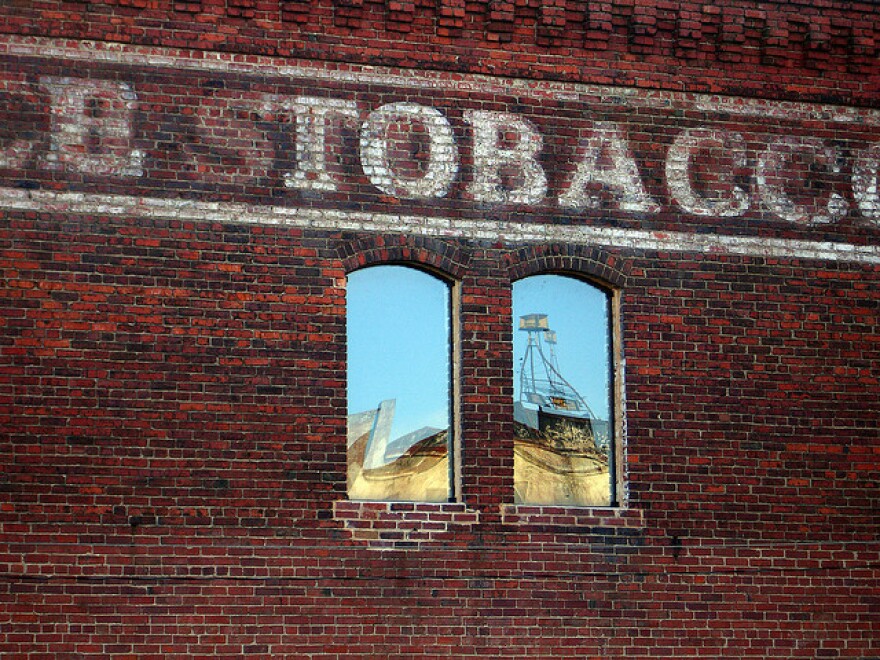

And the same committee recommended that North Carolina continue offer tax breaks to owners who renovate historic buildings.