North Carolina educators have marched in Raleigh repeatedly over the years - and most recently in May - to call for better funding for public schools. While the spotlight is often on teacher pay, the full picture is a lot more complicated.

Here a few school funding questions answered using data from the North Carolina Department of Public Instruction, explained by WUNC's data reporter Jason deBruyn and education policy reporter Liz Schlemmer.

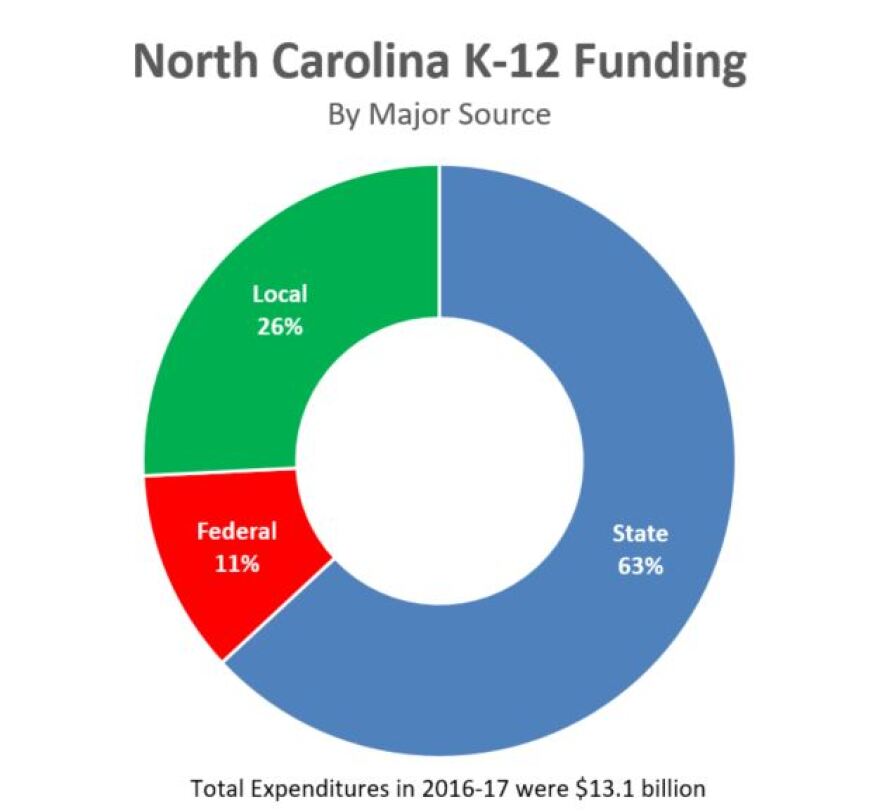

How much of a school's budget comes from the state of North Carolina?

The state contributes about two-thirds to the Department of Public Instruction's overall spending. Counties contribute about a quarter, though some counties give significantly more than others (more on that later). The sources for each individual school district's budget varies based on how many local tax dollars the district receives.

And how much of the state's budget goes to education?

In the late 1960s, more than half of the entire state budget funded K-12 education. That declined through the 1980s and 1990s but has held more or less steady - as a percentage - since the 2000s.

Has per-student spending in North Carolina recovered from the recession?

The state's per-student funding only recently inched back up to what it was before the 2008 recession. The National Educators Association ranked North Carolina 41 among states in 2017 in per-student funding, a measure that controls for student population.

The state government's per-student spending had been increasing up to the recession, but then tumbled. The state's overall budget for K-12 education has since grown to keep up with North Carolina's student population growth and to raise salaries and support growing health benefit costs for teachers, while many specific line items in the education budget have never been restored to what they were before the recession.

The dotted blue line in the graph below tells the most complete picture: when adjusting for inflation, the state's per-student spending remains below what it was in 2008-09.

What are some specific school expenses that have not had funding restored since the recession?

While the state's overall per-student spending has largely recovered from the recession, allocations for certain school expenses have never been restored.

That includes per-student allotments for things teachers see in their classrooms: benefits like teacher assistants, textbooks and instructional supplies. These reductions help explain why many educators describe their schools as under-funded while the state's overall education has actually grown, mostly due to increases in salaries and benefits.

How has teacher pay changed over time?

Similar to overall funding, the state's contribution to teacher pay took a hit during the recession. Average teacher pay has recovered in recent years, though still lags the national average. The most recent report from the National Educators Association ranks North Carolina 39th in teacher pay, which includes the overall average pay including pay supplements districts offer their teachers, paid with local tax revenue.

Is there more to know about teacher pay than just the average?

The state's average teacher pay has a few elements to it. The higher paid teachers in the state are those who still receive phased-out state bonuses for having a master's degree and for having accumulated many years of service as a state employee. And the highest paid teachers are those who still receive those bonuses from the state plus large local supplements paid for by county or city taxes.

The legislature has changed the state's salary schedule for teachers in recent years. The base salary has gone up and teachers now receive pay increases earlier in their careers. Meanwhile, in 2013 state lawmakers eliminated the bonus for having a master's degree, and grandfathered in anyone already receiving that bonus. Lawmakers also got rid of the bonus for longevity, but say it was incorporated into the overall rise in the salary schedule.

How has state funding for public schools changed over time?

The costs of offering benefits to educators has increased faster than their salaries. The vast majority of state education expenditures fund teacher pay. As total compensation for teachers increases, it limits state funds for other resources.

What's the main source of financial inequality among North Carolina's public schools? Why do some seem to be richer or poorer than others?

Counties, through property taxes on residents, supplement the budgets for their local school districts. But not all supplements are created equal. They range from $5,867 per student in the Chapel Hill-Carrboro system to $455 per student in Swain County.

The interactive map below shows the local supplements from North Carolina's school districts.

What does the state do to make the distribution of funding more equitable across the state?

The state adjusts its per-student funding to distribute an additional supplement to low-wealth counties, based on their capacity to raise local tax revenue. Below is a breakdown of which counties receive that supplement.

What are school finance officers biggest concerns?

School finance officers say their biggest challenge is working with limited funds and within strict limitations the state and federal governments place on how districts can spend their money. The point of those limitations is to ensure that school districts spend money on an intended use, such as using funds designated for students with disabilities only on those students. School finance officers say the downside of that lack of flexibility is that it keeps them from doing innovative things with their money, to support the needs and strengths of their own district.

Read more here: What Public School Finance Officers Want You To Know About School Funding